October 2025 Product Release

This month’s updates include expanded loan term options, appraisal status notifications, improvements to lien linking and task tracking, and a new pre-qualification API endpoint.

Originators can now better meet borrower expectations, track appraisals, improve accuracy and accountability, and deliver customizable pre-qualification experiences.

Expanded loan term lengths

Loan officers can now price, structure, and lock across additional loan term lengths (10, 15, and 20 years).

What it means for you:

- Meet borrowers preferred term length needs

- Greater flexibility in loan structuring

- Instant pricing updates across term options

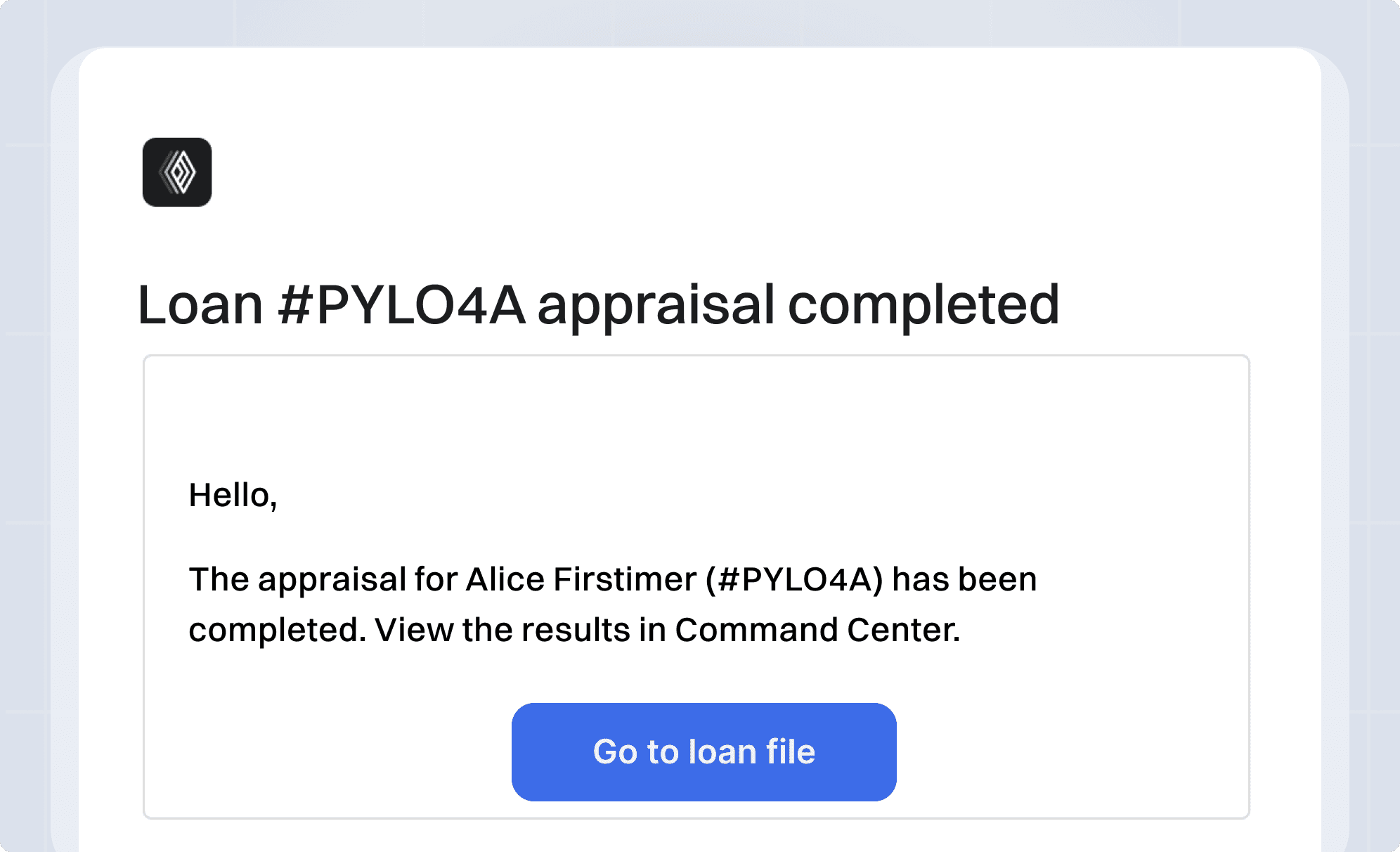

Appraisal status notifications

LOs now receive email notifications of appraisal status changes with deep links to the specific file in the Command Center. Notifications are also available via API.

What it means for you:

- Proactive updates at appraisal order, scheduling, and completion

- On-the-go status visibility

- Faster borrower follow-ups

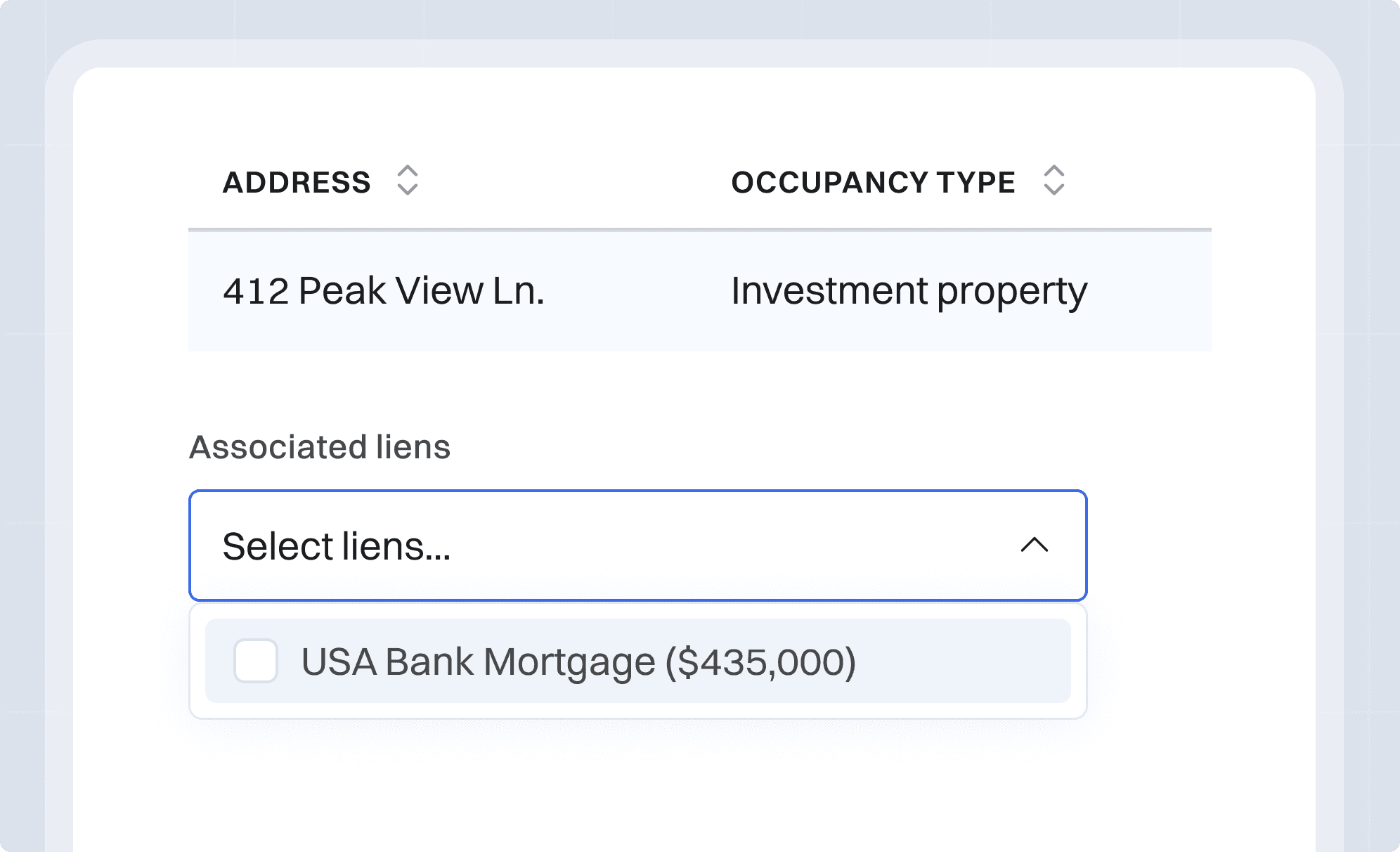

Lien linking for owned properties

Loan officers can now link liabilities from the credit report directly to additional owned properties outside the subject property.

What it means for you:

- Seamless linking across all owned properties

- More accurate income and liability calculations

- Greater confidence when structuring complex borrower profiles

Improved tracking for LO tasks

Task badges now display how long each LO-assigned task has been outstanding, overdue, or took to complete.

What it means for you:

- Smarter prioritization across active files

- Greater accountability and self-management

- Improved visibility for managers to track file progress

API improvements

New pre-qualification endpoint that delivers purchasing power without requiring a full loan application. Pre-qualification can be generated using the same few fields used for scenarios, allowing teams building to Pylon’s API to easily embed pre-qualification flows, surface purchasing power to borrowers, and create customized experiences.