Broker Mortgages Directly to Wall Street

For decades, brokers have specialized in sourcing borrowers and managing relationships while relying on wholesaler lenders to provide capital, underwriting, and fulfillment infrastructure. This division of labor has enabled brokers to build profitable businesses without investing in large-scale mortgage operations.

What brokers may not realize is that the “mortgage factories” at the center of wholesale lenders’ operations are riddled with inefficiencies and manual processes. Over the past 10 years, the cost of originating mortgages has nearly doubled. Not only do these costs get passed directly to brokers, but wholesalers’ outdated approach to origination also creates delays, opacity, and other structural disadvantages for brokers.

Brokers pay for wholesale inefficiency

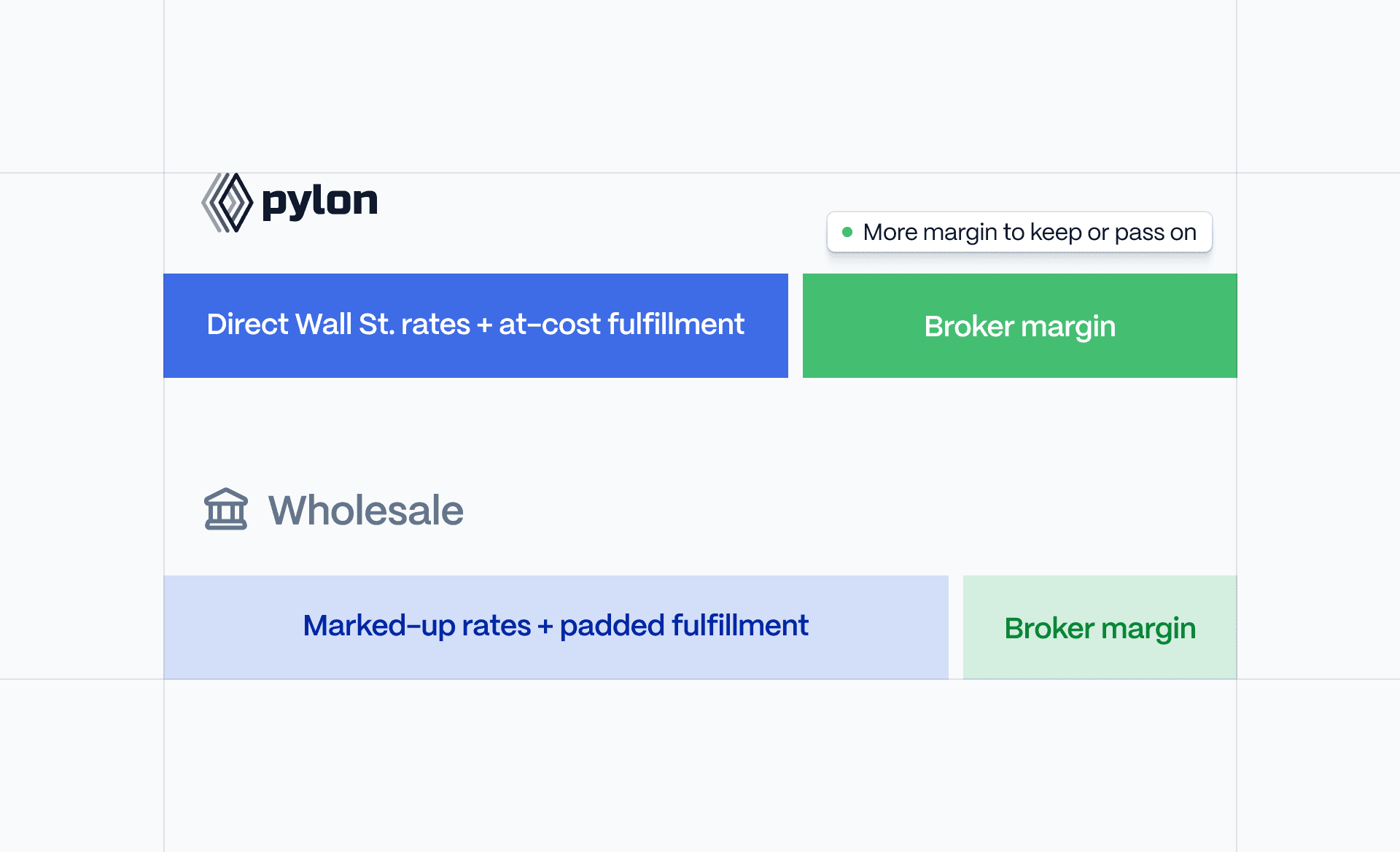

Over the past two decades, while adjacent industries have modernized toward automation, mortgage origination has remained mired in inefficiency. A typical wholesale lender today relies on 15-20 separate vendor solutions, operations staff to coordinate them, and back-office teams for underwriting, processing, closing, post-closing, and quality control. These complex and people-heavy processes drive up costs, which are then passed on to brokers through padded rates and fulfillment costs. The result is a markup of 75-200 basis points relative to the rates wholesalers receive from Wall Street. Because of these padded rates, brokers are forced to make difficult trade-offs between margins and volume.

Underwriting happens in a black box

Because of their manual approach, wholesale underwriters apply guidelines inconsistently. While one file may clear conditions quickly, a similar file may receive additional scrutiny. Brokers have no visibility into underwriting queues and little influence over how guidelines are interpreted, limiting their ability to address borrower frustration. In addition, wholesalers add their own overlays to investor guidelines to protect against rep and warrant risk, increasing complexity and lowering pull-through rate.

Manual processes create delays

Despite the ubiquity of streamlined and digital front-end experiences, mortgage origination is an intricate and largely manual process once files enter the wholesale pipeline. Documents get reviewed by processors, queued for underwriters, checked by quality control teams, and prepared for closing by transaction coordinators. Each handoff introduces delays and potential errors, making it harder to close quickly and causing borrower frustration.

Economics flow to the lender

Because wholesalers fund the loan and assume market execution risk, they get the benefit of gain-on-sale margins and hedging profits, with brokers excluded from this upside. This limits margin potential and prevents brokers from delivering differentiated speed, transparency, and value beyond relationship management.

Fragmented software creates additional friction

The traditional broker tech stack adds another layer of inefficiency on top of wholesale lenders’ already manual processes. Point-of-sale (POS) and loan origination systems (LOS) require extensive data entry, manual document collection, and coordination. Borrowers often spend hours uploading documents through clunky portals and completing redundant forms across multiple systems. Meanwhile, loan officers waste time chasing paperwork, manually structuring loans through trial-and-error AUS runs, and coordinating between disconnected vendor solutions. This fragmented software stack creates friction at every step, from application to closing, forcing many brokers to choose between investing in operations staff or limiting their loan volume.

What’s more, the traditional broker tech stack doesn’t connect seamlessly with wholesalers. Changes to loan files aren’t validated in real time against underwriting guidelines, requiring LOs to take a guess-and-check approach with AUS to make sure structures work. When all the work in the LOS is completed, brokers are required to manually export the file and upload it into the lender portal.

The broker advantage with Pylon

At Pylon, we’ve developed the first mortgage rails, an entirely new alternative to the traditional mortgage lending model. Our mortgage rails automate the entire origination process, from application to Wall Street. This enables us to deliver direct Wall Street pricing, dramatically increase loan officer productivity, and deliver a faster time to close alongside a more seamless fulfillment process.

Forward-thinking brokers have discovered that they can get lender-like benefits on their existing broker license by replacing their wholesale lenders with Pylon. Brokers who originate on Pylon’s mortgage rails can control borrower pricing and capture the gain on sale, including hedging pickup, with no margin padding. They get direct access to Wall Street rates and top lender-grade execution. And they can deliver faster, cleaner credit decisions through software instead of human underwriters.

Direct Wall Street pricing that’s 75-200bps lower

Pylon’s mortgage rails connect brokers directly to Wall Street’s most competitive capital, including institutional investors like Citi, Bayview, and PennyMac. With Pylon, the rates brokers see are the actual cost of capital with no markup. Brokers can choose to price aggressively to grow volume, or maintain market pricing and capture significantly higher margins. Given the typical pricing advantage is 75-200 basis points relative to wholesale pricing, most brokers choose to do some of both.

By pooling loans from many originators, Pylon unlocks better rates than even most mortgage banks can access. The more originators join our platform, the lower rates get. Brokers can also offer concessions directly through Pylon, without needing to go through the traditional wholesale approval process.

Because brokers control Pylon’s loan execution rather than outsourcing it to a wholesaler, they have access to the complete loan economics. This represents not only origination compensation, but also the gain-on-sale value that would have accrued to the lender. As a result, the profit structure shifts from fixed compensation on someone else’s loan to full ownership of the transaction economics. With Pylon, brokers set the total gain on sale, and Pylon shares in a small portion of this margin.

Automation that fuels growth

When loan officers no longer need to spend hours collecting documents, following up on underwriting conditions, and managing exceptions, they have capacity to originate more loans and cultivate better borrower relationships. Brokers using Pylon’s automation-driven platform report that their loan officers can handle approximately 3x the volume compared to traditional POS + LOS + wholesale workflows. This productivity multiplier means brokerages can grow volume and profitability without increasing headcount.

One impactful example of the automation native to Pylon’s platform is our intelligent structuring in Command Center, which evaluates all possible loan structures simultaneously and identifies the best option for the borrower—whether that’s the lowest rate, lowest out-of-pocket cost, or lowest monthly payment. Instead of a manual guess-and-check AUS approach that can leave significant value on the table, our system analyzes every product type, considers all available rate options and point combinations, factors in loan-level price adjustments, and returns the best structure in seconds. This means borrowers get better outcomes, leading to higher satisfaction, more referrals, and stronger close rates.

Pylon’s automation effectively eliminates queue time. The average time from application to closing on Pylon is 18 days across all loan types. In competitive purchase markets, this speed advantage can translate directly to won business. Listing agents and sellers favor offers with faster, more certain closings, and real estate agent referral networks respond to brokers who consistently deliver on timeline commitments.

Modern borrowers expect digital experiences, status transparency, and quick answers to questions about their application. Pylon’s Elements product provides pre-built UI components that deliver on these expectations under the broker’s brand. Borrowers apply online, upload documents through an intuitive interface, and see real-time application status. Brokers can customize the borrower experience as much or as little as they choose, knowing that the experience will always be fast, transparent, and consistent.

The traditional wholesale model creates structural disadvantages that brokers can’t solve through better service or stronger relationships alone. Between wholesalers’ margin padding, manual underwriting bottlenecks, black-box decisioning, and fragmented software workflows, brokers face hard trade-offs between competitive pricing and sustainable margins.

But a new approach is emerging. Forward-thinking brokers are discovering they can bypass these constraints entirely by replacing their wholesale lenders with modern mortgage infrastructure. Check back soon for another blog post where we’ll explore how Pylon’s mortgage rails deliver the pricing control, automation, and speed that transform these disadvantages into competitive advantages.

Sources

Mortgage News Daily. “Mortgage Banking Profits Increased in 2016.” April 13, 2017.

Mortgage Bankers Association. “IMBs Report Slight Production Losses in First Quarter of 2025.” May 16, 2025.